To determine the average number of days it took to get invoices paid, you must divide the number of days per year, 365, by the accounts receivable turnover ratio of 11.4. Companies with more complex accounting information systems may be able to easily extract its average accounts receivable balance at the end of each day. The company may then take the average of these balances; however, it must be mindful of how day-to-day entries may change the average.

Don’t Quit Your Day Job…

Though we’ve discussed how this metric can be helpful in assessing how long it takes your business to collect on credit, you’ll also want to remember that just like any metric, it has its limitations. On this balance sheet excerpt, you can see where you would pull the accounts receivable number from. This is the most common and vital step towards increasing the receivable turnover ratio. Your business’s long-term strategy relies on accurate financial records. With Bench at your side, you’ll have the meticulous books, financial statements, and data you’ll need to play the long game with your business.

- Use the Accounts Receivables Turnover Ratio Calculator to calculate the the quality of receivables and credit sales, the higher the Turnover Ratio, the better the collection frequency of credit sales.

- The net credit sales come out to $100,000 and $108,000 in Year 1 and Year 2, respectively.

- It also covers how the A/R turnover plays a significant role in determining your business’ overall cash flow.

- For instance, industries with shorter payment cycles, such as retail, may have higher turnover ratios, while industries with longer payment cycles, such as manufacturing or construction, may have lower ratios.

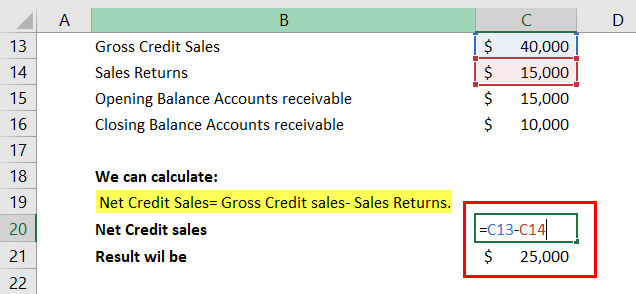

- The canonical measure uses net credit sales (sales on credit netting out sales returns and allowances), but for companies which do most sales on credit using revenue will work decently as well.

What is your current financial priority?

Deloitte highlights capturing early payment discounts as one of the best ways to improve AP processes. Offering an early invoice payment discount demonstrates your understanding of customer priorities, something that will speed up collections and build better customer relationships. Aligning AR and sales using cash flow data will align both teams and deliver great customer experiences. As a result, your AR team will make fewer errors, have lesser manual follow-ups to execute, and collect on invoices faster. Here are some of the best ways to improve your receivables turnover ratio.

What is the accounts receivable turnover ratio?

Accounts receivable are effectively interest-free loans that are short-term in nature and are extended by companies to their customers. If a company generates a sale to a client, it could extend terms of 30 or 60 days, meaning the client has 30 to 60 days to pay for the product. Furthermore, because this ratio considers the average performance across your entire customer base, it lacks the precision needed to pinpoint specific accounts at risk of default. For a deeper understanding at this level, it is advisable to generate an accounts receivable aging report. Net credit sales are revenues made by a company that it extends to consumers on credit, less all sales returns and allowances. Net credit sales are calculated as the total credit sales adjusted for any returns or allowances.

While a higher accounts receivable turnover is generally positive, an extremely high ratio could suggest overly strict credit policies. It’s crucial to balance quick collections and good customer relationships. For example, a company that has an accounts receivable turnover of 13.5 would indicate very efficient credit and collection processes, as it is collecting its receivables relatively frequently throughout the year.

It measures the number of times a company turns its accounts receivable into cash over a specific time period, typically a year. Generally, the higher the accounts receivable turnover ratio, the more efficient a company is at collecting cash payments for purchases made on credit. The accounts receivables turnover ratio captures your average customers’ payment behavior. If all of your customers behave similarly, the ratio will work well for you. However, the number doesn’t represent much if you have widely divergent customers. Let’s say your company had $100,000 in net credit sales for the year, with average accounts receivable of $25,000.

We’ll do a calculation using a fictional company’s financial records for a period of January 1 to December 31. When inputting your own data, feel free to use whatever timeline you prefer. Receivables turnover ratio is a measure of how effective the company is at providing credit to its customers accountant the and how efficiently it gets paid back on a given day. Let’s also assume both customers pay exclusively on credit for simplicity’s sake. If A regularly pays within one day of receiving an invoice while B pays on a Net 90 basis, the AR turnover in days will lie somewhere around the 40-day mark.

The longer is takes a business to collect on its credit, the more money it loses. Accounts Receivables Turnover refers to how a business uses its assets. The receivables turnover ratio is an accounting method used to quantify how effectively a business extends credit and collects debts on that credit. Although this metric is not perfect, it’s a useful way to assess the strength of your credit policy and your efficiency when it comes to accounts receivables. Plus, if you discover that your ratio is particularly high or low, you can work on adjusting your policies and processes to improve the overall health and growth of your business.

Assuming that this ratio is low for the lumber industry, Alpha Lumber’s leaders should review the company’s credit policies and consider if it’s time to implement more conservative payment requirements. This might include shortening payment terms or even adding fees for late payments. The accounts receivable turnover ratio, also known as the debtors turnover ratio, indicates the effectiveness of a company’s credit control system.

By learning how quickly your average debts are paid, you can try to determine what your cash flow will look like in the coming months in order to better plan your expenses. Plus, addressing collections issues to improve cash flow can also help you reinvest in your business for additional growth. To calculate the receivable turnover in days, simply divide 365 by the accounts receivable turnover ratio. If you have some efficient clients who are always on time with their payments, reward them by offering some discounts which will help attract more business without affecting your receivable turnover ratio. It’s important to track your accounts receivable turnover ratio on a trend line to understand how your ratio changes over time.